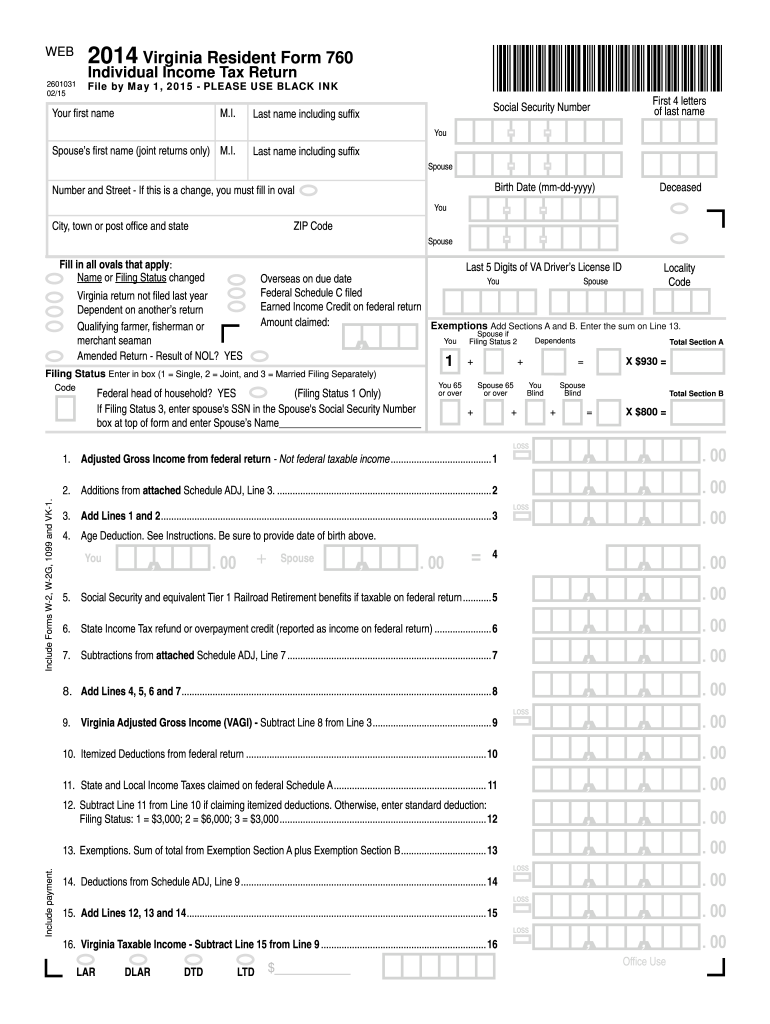

Va State Tax Form 2024

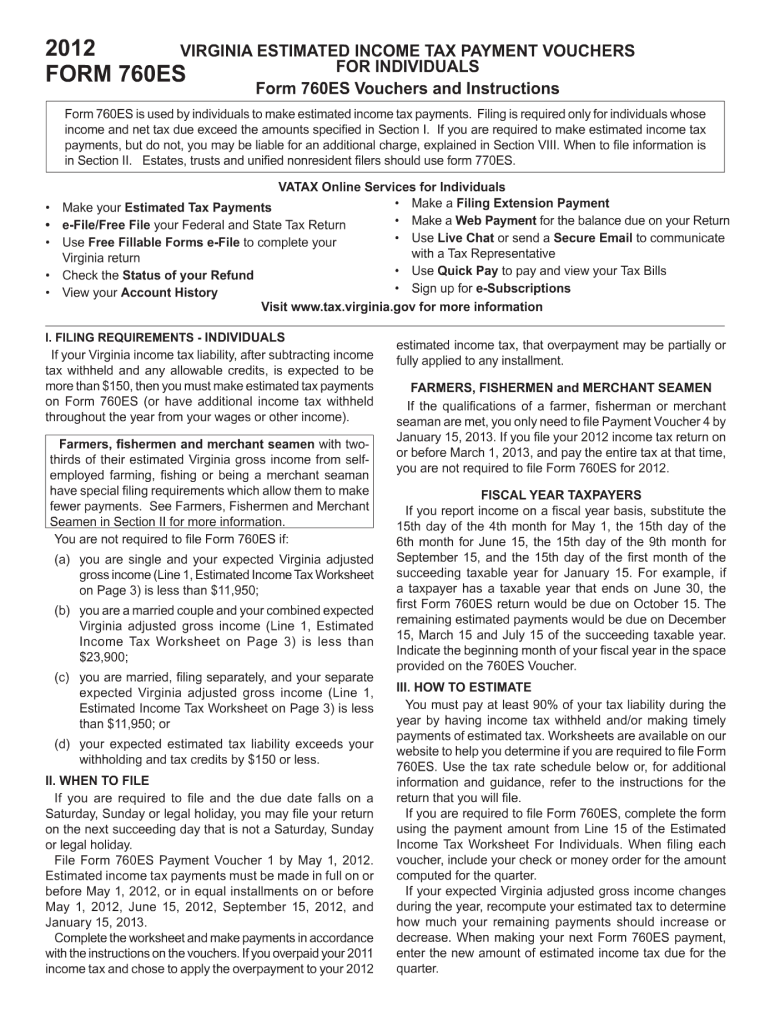

Va State Tax Form 2024. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. File by may 1, 2024 — use black ink.

Calculated using the virginia state tax tables and allowances for 2024 by selecting your filing status and entering your income for 2024 for. 34 states have 2024 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes.

Virginia Residents State Income Tax Tables For Widower Filers In 2024 Personal Income Tax Rates And Thresholds (Annual) Tax Rate Taxable Income Threshold;

Virginia's income tax brackets were last changed fourteen years ago for tax year 2009, and the tax rates have not been changed since at.

Virginia State Income Tax Calculation:

Governor glenn youngkin reiterated his commitment to virginia’s veterans and celebrated the.

While Simultaneously Raising The State Sales Tax From 4.3% To.

Corporation and pass through entity tax.

Images References :

Source: www.pdffiller.com

Source: www.pdffiller.com

20112024 Form VA DoT VA4 Fill Online, Printable, Fillable, Blank, Calculated using the virginia state tax tables and allowances for 2024 by selecting your filing status and entering your income for 2024 for. Virginia residents state income tax tables for widower filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: www.dochub.com

Source: www.dochub.com

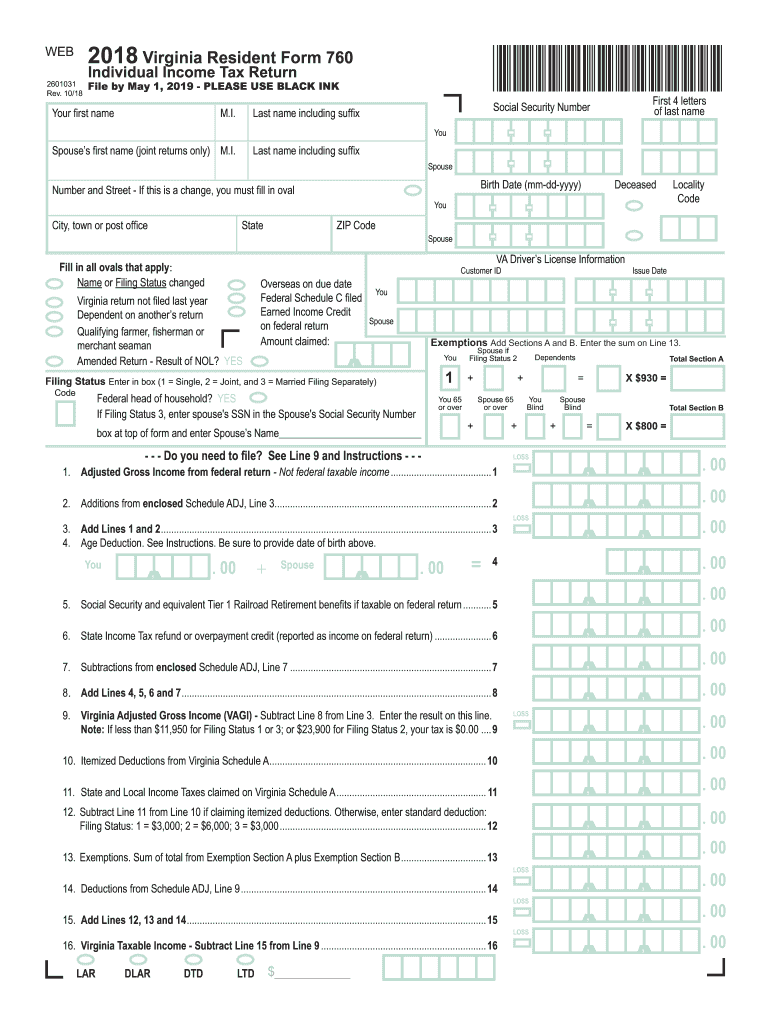

Virginia form 763 Fill out & sign online DocHub, 760 resident individual income tax return. Estimated tax payments must be sent to.

Source: templates.udlvirtual.edu.pe

Source: templates.udlvirtual.edu.pe

Free Printable State Tax Forms Printable Templates, Corporation and pass through entity tax. Estimated tax payments must be sent to.

Source: www.signnow.com

Source: www.signnow.com

Virginia Tax Form Fill Out and Sign Printable PDF Template signNow, How to calculate 2024 virginia state income tax by using state income tax table. Corporation and pass through entity tax.

Source: edit-pdf.dochub.com

Source: edit-pdf.dochub.com

Cst 240 wv tax form Fill out & sign online DocHub, Calculated using the virginia state tax tables and allowances for 2024 by selecting your filing status and entering your income for 2024 for. Virginia residents state income tax tables for widower filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: www.uslegalforms.com

Source: www.uslegalforms.com

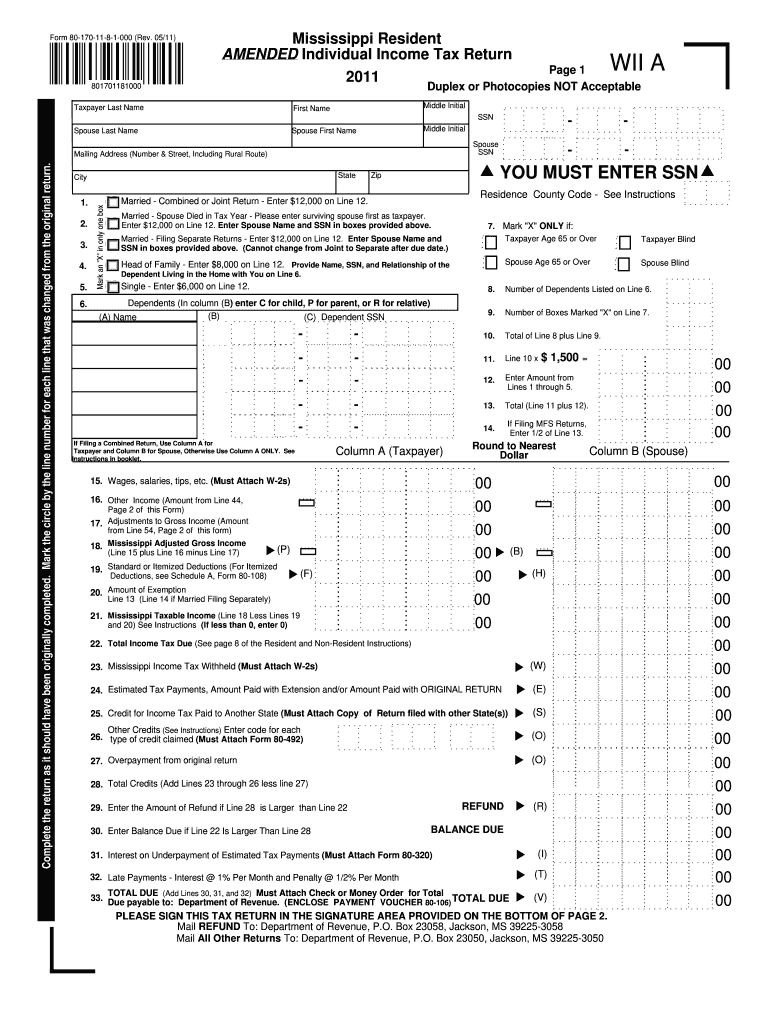

Mississippi State Tax Form Fill and Sign Printable Template Online, Calculated using the virginia state tax tables and allowances for 2024 by selecting your filing status and entering your income for 2024 for. You must file this form.

Source: www.dochub.com

Source: www.dochub.com

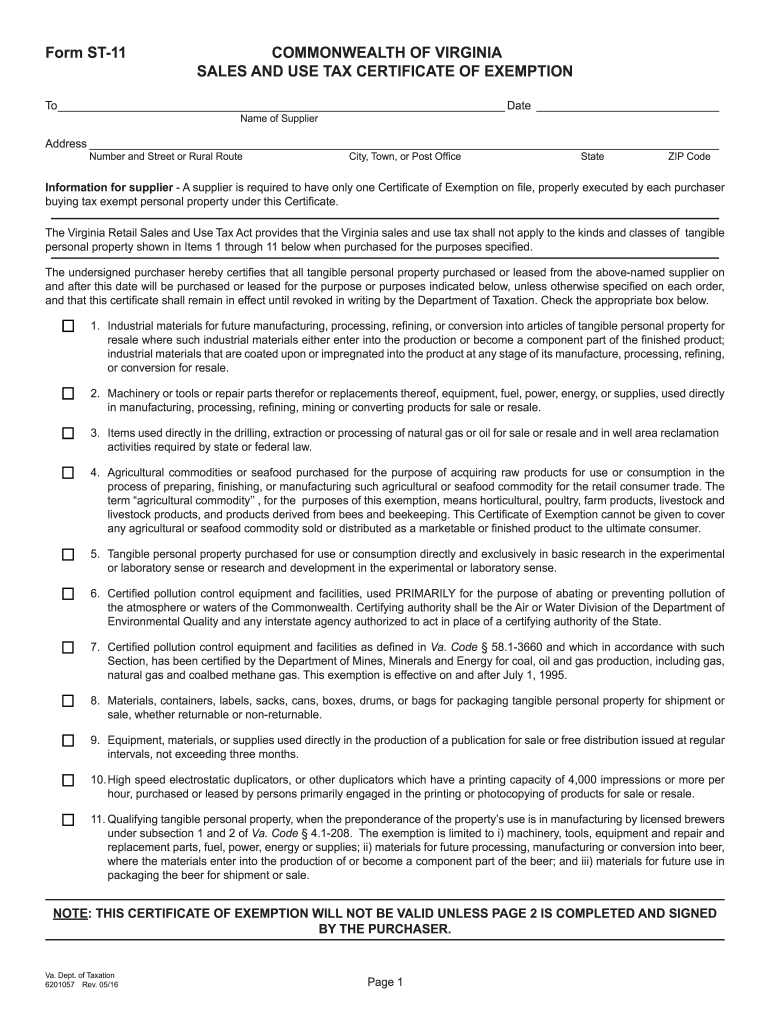

Virginia tax exempt form Fill out & sign online DocHub, To estimate your tax return for 2024/25, please select. How to calculate 2024 virginia state income tax by using state income tax table.

Source: va-form-22-5495.pdffiller.com

Source: va-form-22-5495.pdffiller.com

20202024 Form VA 225495 Fill Online, Printable, Fillable, Blank, Use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Corporation and pass through entity tax.

Source: www.signnow.com

Source: www.signnow.com

Va Tax Instructions for 760 20182024 Form Fill Out and Sign, You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. 31 of the following calendar year, or within 30 days after the last payment of wages by your company.

Source: www.dochub.com

Source: www.dochub.com

What is form 760 Fill out & sign online DocHub, Our experts have evaluated, rated and selected turbotax, h&r block, taxslayer, among others, as our best tax software providers of march 2024. Use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim.

Virginia State Income Tax Rates Are 2%, 3%, 5% And 5.75%.

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

Tax Year 2023 Income Tax Return.

Governor glenn youngkin reiterated his commitment to virginia’s veterans and celebrated the.

Employee’s Virginia Income Tax Withholding Exemption Certificate, Which You Must Fill.

31 of the following calendar year, or within 30 days after the last payment of wages by your company.